- Jyoti Rahman

Macroeconomic policy is like driving a bus. When you are on a bus, you want to get the destination as fast as possible. Similarly, we want the economy to grow as fast as possible. Without growth, there is no job, income, or development. But just the way a bus needs to slow down if on a winding road or a crowded street, macro policymakers need calibrate their policy settings to the economic conditions. Sometimes, this meas slowing the pace of economic growth so that the economy can stabilize.

This had been the case for Bangladesh even before Monsoon Revolution. Like many other countries, Bangladesh faced external shocks in 2022 in the form of Ukraine War and post-pandemic global inflation. However, macroeconomic policy did not recalibrate to stabilize the economy. In fact, policy settings worsened matters. Reserves bled. Taka depreciated. Inflation reached double digits.

Underlying pre-pandemic conditions — megaprojects with not-so-straightforward returns and questionable financing, energy sector and banks laden with problems — further added to the instability.

Then the revolution happened.

So the bus driver now needs to slow down, perhaps reverse gear even in the short term!

What does this mean in practice?

First, the banks.

There are 60 or so banks in Bangladesh. About 10 or so are okay. Another 10 are practically insolvent. The rest also have problems.

If there is one bad bank, a standard policy solution might be to allow it to fail. Most depositors are usually covered by some form of insurance, often publicly guaranteed implicitly or explicitly. So the depositors get their money back, and investors lose out.

But when there are 10 or so bank in that situation, there is a systemic issue. So, what to do?

The central bank and the interim administration has replaced the boards of these problem banks. The next step will be a thorough audit to understand the extent of the ‘hole’. Then will come ‘solutions’. In the meantime, it’s vital that confidence is maintained.

The problem is daunting. However, banking problems are a ‘known known’ — they have happened in many countries over the centuries, and the technocratic solutions are well known. Of course, they require political will. Fortunately, there is no reason to doubt the policymakers’ willingness at the moment.

This is a can that cannot be kicked down the road, and everyone knows it!

The good news here is that inflation appears to be easing, though still quite elevated. The Bangladesh Bank governor expects inflation to decline to 7% by winter. The challenge will be to reduce it further to 5%, which may require much tighter policies.

One key challenge here is that Bangladesh Bank and the Ministry of Finance are modernizing their policy framework at a time when both institutions (like every other public institutions) are dealing with severe personnel problems. Recall, the central bank governor and two deputies fled after the revolution!

(Imagine that — a central bank governor fleeing after a political change, that’s how bad cronyism was under the fallen despot!).

Thirdly, the external sector.

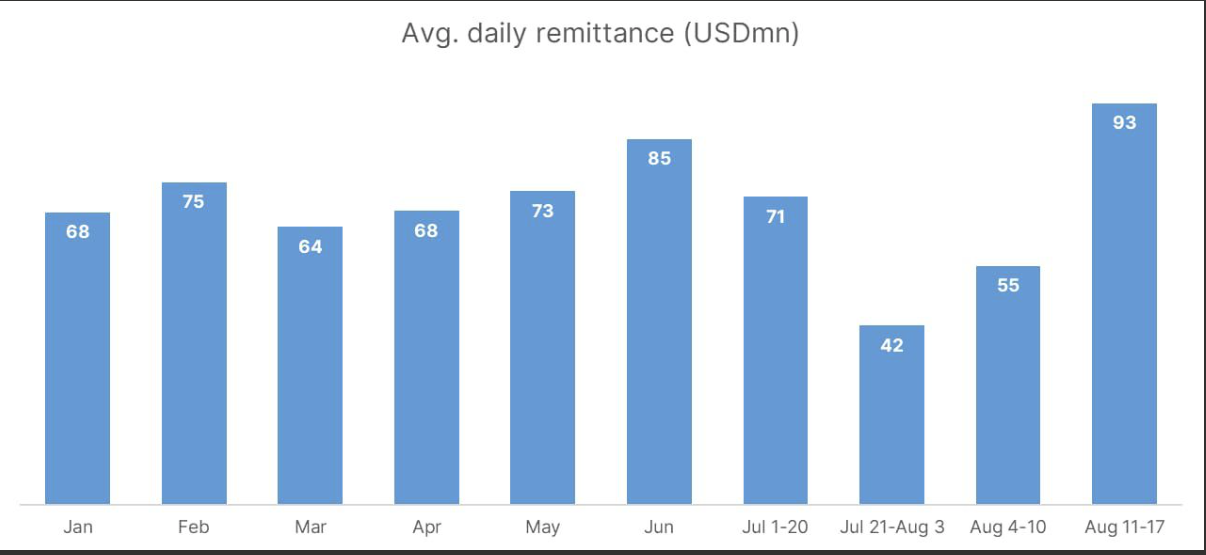

On the plus side here, remittances are booming post-revolution. For two years before the revolution, remittances had been sluggish even though people had been leaving the country in record numbers for work, and the recipient countries’ job markets have been red hot. This was because the remitters were expecting a depreciation of taka and relied on informal networks which were buoyed by money siphoned out by the fallen regime’s cronies.

Then came the remittance boycott during the revolution, which appears to have had a material impact! *

If the remittance remains strong, it can create a virtuous cycle of exchange rate stability. Plus, the steady stream of news of financing from multilateral agencies and development partners help.

On the other hand, there is considerable worry on the exports front — I will leave it to others to discuss.

That itself was a significant worry. More importantly, external imbalances, bad banks, and authoritarian politics — that’s what made the noxious Monsoon cocktail of the Asian Financial Crisis of 1997-98!

Well, we didn’t need to experience the cyclone that is a full blown financial crisis to throw out our despot. So we are somewhat ahead of our neighbors of a generation ago. And work by Daren Acemoglu and colleagues suggests that democratic transition can in fact boost growth if the newly democratized governments pursue reformist policies.

On the other hand, work by Dani Rodrik and colleagues suggest that reform is not always automatic or straightforward.

Stabilization means slowing down the bus, or even reversing it somewhat, because we are in a bumpy road. But ultimately, we may need to fix the bus — change engine oil or wheel alignment — before we can speed up. That takes us to the realm of micro issues that my colleagues will talk about.

I think I covered most of the points, but it’s a good idea to write these things down, if nothing else than for archival purposes. There were a few questions.

- Institutions, purges, reconciliation

In light of severe personnel problems in key institutions, we have to reconcile with many that served the previous regime. Our problem is aggravated by the fact that many who served the old order are not just of a different political or ideological persuasion, but also are severely ethically challenged and are frankly incompetent. This makes reconciliation, as worthwhile as that is, not very useful for economic governance.

- Headwinds before Ukraine: covered above

- Banks: covered above (I think I said something more forceful, but sadly didn’t write down what I said)

- Corruption / data integrity / transparency

Problems are noted, and some of the issues were covered by other panellists.

- New IMF program

The interim administration has requested resetting the IMF program with additional, front-loaded financing. I understand this will be negotiated in the coming months. It’s a good idea. Watch this space.